A Guide:

Personal Finance

Everything you need to know about personal finance.

Last Updated: October 10, 2022 Before we get started, here’s an intro to me!

Meet me.

Justin Huynh

I'm a Product Manager at ConsumerReports building their money and personal finance product, an Accredited Financial Counselor® candidate, and a graduate from the University of California, Davis in Economics, Data Analytics, and Economic Analysis.

My most recent stint was building product at Doorvest, a FinTech startup focused on advancing financial security for everyday Americans.

I’m a personal finance geek, real estate investor, and self-pronounced multidisciplined learner. I live and breathe the learn by doing mentality, as cliché as it sounds.

By night,

1

Intro

The goal of this guide is to teach you everything about personal finance for beginner to intermediate level situations. Advanced personal finance will not be covered as it is likely to require specialized advice or the help of professional counsel to implement. This guide will also not include investment strategies as that will be covered in a separate guide.

Disclosure: This guide is for informational purposes only. Please consult professional counsel.

What is personal finance?

Personal finance is simply the ability to manage one’s money. Human nature makes personal finance more difficult as we naturally crave status and higher wellbeing. And for this reason, money is the number one stressor for American families and number one reason for divorce.

Understanding money, how to manage it, and how to make it work for you will lead to a happier, more fulfilled life.

This is why it is crucial to gain the basic skill of personal finance.

Let’s begin.

2

The Process

When the wealthy work with a financial planner, they all go through the same basic steps. This is called the financial planning process.

Understand your current financial standing

To do this, you’ll need to gather all financial information. For most people, this involves gathering tax documents and bank documents. These have crucial information like your salary, taxes paid, investment assets, and liabilities like a mortgage.

Set goals

There is no point in amassing wealth with no way to spend it. Money is a tool that is used to enjoy life. Therefore, you must set goals that allow you to spend your money to enjoy your life.

Analyze courses of action and their alternatives

Within personal finance, there is the “3 Alternative Rule” — there are at least three alternatives that could lead to the same goal. It is a matter of choosing the best one that makes you feel the most secure.

Develop the plan

After choosing all of your courses of action, you must develop the final plan by putting it together. This will be your personal finance bible — the document you live by.

Implement the plan

Now that you have developed your plan, you have to go through with it. A plan not implemented is failed from the start.

Monitor progress and update accordingly

Albeit, life is not perfect, so you’ll need to edit your plan as you go to better fit the today version of you.

3

Current Situation

In order to move forward, you must understand where you stand currently. If you don’t, you’ll basically be taking a swing in the dark. In personal finance, the most basic forms of understanding your current standing is through a Net Worth and Cash Flow analysis.

The Net Worth Calculation

Calculating your net worth is fairly simple. The formula is

Net Worth = Assets - Liabilities

The purpose of the net worth calculation is to see how much “money” you own and how much “money” you owe. This serves a base point when looking at changes month-over-month or year-over-year to see if you are moving in the right direction to achieve your goals.

Your assets include anything that can be converted to cash. Personally, I put my own caveat on this — see below.

Assets

Assets include anything of value that can be converted to cash without significant loss of value and is worth more than $1000.

The reason why I specify “without significant loss of value” is because of cars. Cars are considering “depreciating assets.” Although they can be quickly converted to cash, it usually involves losing a significant amount of money to do so. The “worth more than $1000” part is to deter adding in small items like furniture or technology (like phones and computers) as it’s unlikely that these would be liquidated for cash in the first place given they’re a staple in our lives now.

With this new definition in mind, there’s basically three assets classes that will make up most of your “Assets” number. These three being:

Cash (either in the form of checking and savings accounts or in paper form)

Investments (like stocks, bonds, investment properties, primary residence, etc.)

Alternatives (gold, silver, NFTs, cryptocurrency, etc.)

For our purposes, let’s assume I have $10,000 in cash, $150,000 in investments (as I do not have a permanent residence), and $50,000 in alternatives. This leaves me with:

Net Worth = $(10,000 + 150,000 + 50,000) - Liabilities

Net Worth = $210,000 - Liabilities

What’s left in this formula is the Liabilities. Liabilities are anything that you owe to someone else. By this definition, things like:

Credit card debt

Student loans

Mortgages

Auto loans

and more

can be included as part of this calculation. Let’s assume I have 0 credit card debt, but I have significant student loans and auto loans totaling to $35,000. Now, we have the 2 components needed to calculate Net Worth.

Net Worth = $210,000 - $35,000

Net Worth = $175,000

This is how much you would be worth if you liquidated all of your material belongings and paid off your debts. Note, many people, especially those younger than 35 often have negative net worth due to student loans, auto loans, and mortgages. This means you may have ended up with a negative number here.

The Cash Flow Analysis

This is basically a fancy way of seeing where your money comes in from and where it is going. Many people actually already perform this analysis if they have tried budgeting before.

The first step: figure out where your money is coming in from.

Simple enough right? For most people, this is simply a paycheck from their employer. For others, this is a complicated calculation if they are self-employed, are receiving income from multiple aid services, or are retired. You can find this by looking at deposits into your checking account (or paystubs from your employer work as well).

The only other step is to figure out where your money is going.

For most people, this can be broken down into

Rent and other fixed expenses (like utilities, internet, etc.)

Investments (401k, IRA, etc.)

Savings (vacation funds, emergency fund, etc.)

Fun money (going out, clothes, etc.)

Of course, there are outlier costs depending on your lifestyle, but most things fit into these 4 buckets. Most financial experts will tell you that the following breakdown is healthy and common:

Rent and other fixed expenses (like utilities, internet, etc.) = 50-60% of take-home pay

Investments (401k, IRA, etc.) = 10%

Savings (vacation funds, emergency fund, etc.) = 5-10%

Fun money (going out, clothes, etc.) = 20-35%

These are good rules of thumbs to follow. For someone who makes $60,000 per year, this means:

Rent and other fixed expenses (like utilities, internet, etc.) = $30,000-36,000

Investments (401k, IRA, etc.) = $6,000

Savings (vacation funds, emergency fund, etc.) = $3,000-6,000

Fun money (going out, clothes, etc.) = $12,000-21,000

If a person was to follow this until retirement, they would end up retiring with $2,655,555 in investments alone based on average returns. Not too bad considering this is something most people can do.

Takeaways:

Find your financial documents and organize them.

Figure out where you stand using a Net Worth and Cash Flow calculation.

See how you fit into the general guideline percentages noted above.

4

Spending

Let’s start with the “Spending Categories.”

Rent and other fixed utilities

Fun Money

These are two categories where money comes out of your pocket and practically disappears. However, they fulfill a very important part of your life: living and enjoyment. We exist to live and enjoy our lives until the next. But there are better ways to spend money than pulling out your oversized wallet and using cash.

Credit Cards

Credit cards have a bad rep. Popular financial talk host, Dave Ramsey, is particularly against the use of debt, especially debt with high interest rates. And popular media also continues to push that credit cards are evil. For example, some headlines look like,

“Four in 10 adults in 2017 would have to either borrow money, sell something, or simply not be able to pay if faced with a $400 emergency expense.”

“A debt crisis is on the horizon.”

“The looming debt crisis will hurt these Americans the most.”

These are nothing but sensationalized news headlines to grab your attention. Their whole job and business is based on scaring you to clicking their article. But credit cards are one of the most fundamental parts of an optimized personal finance approach.

Credit cards can save you THOUSANDS of dollars in perks, but also, they help build up your credit score, which then may potentially save you hundreds of thousands in interest. Let me explain:

Assuming you pay your credit card bill on time, you will benefit from credit card use. If you are unable to pay your credit card on time, you’ll be faced with outrageous interest rates (upwards of 25% Annual Percentage Rate, or APR).

Credit card bonuses often offer thousands of dollars in points, warranty extensions on expensive purchases, rental car insurance, and protection from scams. Personally, just by signing up for one, I’ve earned a vacation worth upwards of $1,500. And this is very common. However, just a couple guidelines when getting a new card:

Never sign up for retail credit cards. They seem cool in the moment if you shop at a particular store often, but they often have the most fees and the highest interest rate. Plus, you’ll begin to get a ton of spam sent your way.

Only sign up for ones with rewards. The whole point is to get a reward. Some rewards include cashback, travel points, and more.

Cards with fees are actually worth it. The best rewards come from credit cards with fees. However, depending on the reward, you will need to weigh the cost of the fee versus that of the rewards.

Don’t open too many. You only really need 2 credit cards. One for cashback, and one for travel. The average American has 4, but it’s unnecessary.

Once you get your credit card, follow a few rules:

Always pay it off.

Try to negotiate fees and lower interest rates (APR).

Keep all cards active.

Ask for more credit (AKA a credit increase) every 6-12 months.

Read the credit card pamphlets and fine print for “secret” rewards.

Credit Scores

Okay, now you have a credit card, and you’re maximizing its use. Where’s the hundreds of thousands in savings, Justin?

I’m glad you asked. This comes from something called the Credit Score.

Your credit score is made up of 5 primary components:

Payment history (35%) — How reliable you are in paying off debt

Amount owed (30%) — How much you owe to how much total credit you have available

History (15%) — How long you’ve had credit

New Credit (10%) — How many new accounts you have

Types of Credit (10%) — How many types of credit you have

In general, it is best to have no late payments, little owed from month-to-month, have older credit accounts, and have more variation in the types of debt.

These components are then put into a formula by credit agencies like TransUnion and Experian to spit out your credit score.

The range of scores can be between 300 and 850 (higher is better). Those with excellent credit are generally those with 720+ scores. This is fairly easy to achieve if you pay off your credit card on time. For reference, I was able to hit an 800 credit score with only one credit card as a college student by paying it off each month. No fancy tricks.

Now, here’s where the savings come in. Imagine you want to purchase a primary residence (a home) worth $500,000. You want to use a 30-year mortgage (as everyone does).

If you have an “Excellent” score of 720, your interest rate might be 3.5%. By the time you have paid off the house, you would pay $246,673.48 in interest.

If you had a “Poor” score of 600, your interest rate might be 4.5%. By the time you have paid off the house, you would pay $329,923.01 in interest.

And this is exactly why I always tell people to sign up for credit cards as early as possible, so you have the maximum time to build a high credit score.

Basically what I’m getting at is that you should use credit cards for all possible spending. There are things that won’t accept credit cards, which is when you should use cash or debit. This ensures that you maximize the credit card rewards for money you would have spent anyways. This also helps you build your credit score to save you even more money.

Being conscious about your spending decisions.

One of the most important aspects is to be conscious about what you are spending your money on.

As you progress through life, you’ll begin to hear more “don’t spend money on that” and “buying that is a waste of money.” Even worse, I hate the people who say “if you just invested the $5 daily latte, you would have $X amount of money in 40 years.” These are the people who make you feel guilty about spending your own money.

I subscribe to a different rule, one that comes from the Minimalism movement.

“Minimalists are those who are deliberate about removing the excess in their lives and choosing to pursue things that are more meaningful.”

Put another way, and popularized by Marie Kondo, choose the things that “spark joy” in your life.

If you value cars, spend money on cars. Sure, they’re depreciating assets, but they might spark joy into your life.

“There is power in saying no to the things we don’t care about. But there is even more power in saying a big YES to the things we love.”

The connecting philosophy here is to spend A LOT on the things that you love — and then cut costs mercilessly on the things you don’t love. It’s not simply about cutting expenses on random items that you enjoy, but rather cutting expenses on the random items you don’t enjoy.

Let’s look at two examples: me and my brother.

Me

I value tech, saving time, optimizing productivity, and living a simple and functional lifestyle.

What I spend my money on:

my computer setup

productivity and automation software

minimal, cheap clothing

a car that will take me far

My brother

My brother values fashion, collectibles, independence, and fun.

What my brother spends money on:

collectible cards

collector shoes like Jordans

high fashion brands

a nice, luxurious apartment

As you can see, we value very different things and practice a very different lifestyle. And as such, our spending habits are different, but we’re both happy. I would never buy collectible cards, but my brother is gladly willing to spend thousands on a signed Kobe Bryant card. Vice versa, he would never buy productivity software, whereas I overly spend on productivity software.

What I’m getting at here is to spend on the things you love. And screw the people who say you are wasting money. When I say this, I mean within reason. I don’t mean go buy a Lamborghini Aventador when you make $30,000 per year. That’s obviously stupid. Don’t be stupid.

Takeaways:

Use a credit card for all purchases, if possible.

Pay off your credit card in full every month.

If credit card is not accepted, use a debit card.

Be extremely intentional on what you spend money on.

5

Saving

This section will cover the other 1 of the other 2 categories:

Savings

This is the part where you think about your future. What do you want out of life? What makes it worth it? What do you want to experience by yourself and with others?

For me, it’s about reaching financial independence as quickly as possible. It’s being able to spend money without thinking about it. It’s about being able to eat at a restaurant with friends and be able to cover the whole bill. It’s about being able to truly work on things I want to work on — one of my coworkers put it perfectly, “you don’t want to work for profit.” These are my aspirations. You’ll need to figure out yours.

How To Reach Your Money Goals

Many people often tell you to save or invest your money. But why are you saving your money? This is where you need to set intentional goals. While I said before to be intentional about how you are spending your money, I also believe you need to be intentional about saving your money.

As a person who believes in habits (read: The Power of Habit, if you haven’t already), I believe that developing the habit of savings and investing is much more important. When setting new goals, especially around the New Year, people make extravagant and over-the-top goals.

“I will start saving 50% of my paycheck starting now.”

This is how most people set goals. Considering the recommended savings + investing rate is 10%, this 50% is over-the-top. Not only that, but would you even be able to live with only 50%. Of course, this is simply an example, but this is how many conversations I have go.

In reality, it would be much more impactful to set slow and sustainable goals, and slowly increase the goal from there.

For example, let’s say your goal is to save $1,000 per month for a downpayment on a future home. If you can just go out and do this, good for you. For those who can’t, here’s my recommended approach:

In month 1, try to save $250

In month 2, try to save $500

In month 3, try to save $750

In month 4, try to save $1000

And now you’re hitting your $1000 goal. Each month, the amount you saved only increased by $250. And this makes it much more manageable from a psychology standpoint, but also from a budgeting standpoint. It might seem “slow”, but in reality, in just 4 months, you went from saving $0 per month to saving $1000 per month.

Doing this “cold turkey”, or right away without preparation, is often too difficult for people to do sustainably.

Savings

So, now that we got the “how” down. This is where we get to the “why.” Why do you want to save?

For younger people, this might mean saving for a wedding, travel, emergency funds, and more. For older people, this might mean your child’s tuition, retirement, and a primary home purchase.

I typically teach people The Bucket Method. And the best savings account use The Bucket Method to organize the money inside. The idea is to breakdown your savings accounts into separate buckets, each which represents something you are saving for.

Below, you can find a breakdown of a savings account totaling $47,000. This person cares about 4 different “buckets” that they are saving for.

Savings Account Breakdown “The Bucket Method”

Essentially, you are trying to figure out what your “buckets” are. Sometimes, this comes extremely natural for people. Sometimes, it doesn’t. For those who need a bit of help, here are some questions to think about (in the order I would approach them):

Do you have an adequate emergency fund (6 months of expenses)?

If no, this should be priority number 1.

Write a list of the things you want to do in the next 3 years. How much do each of these things cost?

Once you figure out the ballpark numbers, this will inform how much you need to save on a monthly basis.

Do you see any large purchases in the next 5 years (a house downpayment, car, etc.)?

If yes, start adding to your savings account now.

Since savings relies heavily on “wants”, it generally is highly personal how much you need. The only part I will recommend wholeheartedly, is to have at least 6 months of expenses. If you are more risk-averse, I would also recommend upwards of 12 months of expenses.

Saving Accounts

It only makes sense that your ‘savings’ goes into a savings account. Why? 1. You get a tiny bit more interest that that of a checking account. 2. Moreover, it creates a psychological barrier between your savings and checking accounts.

On #1, the interest rate is slightly higher. At a big bank like Bank of America or Wells Fargo, you’re likely to get 0.000000000000001% interest (exaggerated, but there’s basically no difference between 0.001% and the previous number). This is better than 0%. But we can do better. Online banks like Ally Bank (#notsponsored) offer higher interest rates in savings accounts called “High Yield Savings Accounts”. At the time of writing, it hovers at about 2%. It’s not life changing interest, but interest nonetheless.

On #2, having separate bank accounts for your savings and checking has statistically proven fruitful for savers. This is because it adds friction to get access to your money. And most people are incredibly lazy, and this is usually enough friction for them not to withdraw from savings for fun money. To add another layer of friction, host your savings account at a SEPARATE bank to your checking account. This causes delays in how fast money transfers and is more difficult to transfer money immediately back and forth, which may reduce the urge to ever need to transfer from your savings.

As a bonus, finding a savings account that allows you to have “Sub-Savings Accounts” is an extremely useful feature. This is basically the “Bucket Method” mentioned above. You can create a sub-account for each bucket you want to save for. This might look like a separate sub-account for a vacation fund, another for a wedding fund, another for a honeymoon fund, etc.

Takeaways:

Open a high-yield savings account separate from your checking account bank. Ideally, this account would have a sub-account feature.

Save enough for at least a 6 month emergency fund.

Begin brainstorming for what other buckets you would want to save for after saving for your emergency fund.

6

Investing

This section will cover the last topic: investing! (if the title wasn’t apparent enough)

If you mention ‘personal finance’ to someone, generally the first thing they’ll talk about is investing. It’s definitely a big part of the personal finance game. You basically can’t get rich by saving money. Investing is the art of making your money make money. Before we get into investing, we need to understand something called compound interest.

Compound Interest

This following graph doesn’t even include the amount of savings you might accumulate over those 40 years. Not only that, notice the interesting part about this chart. Your total contributions is $240,000 meaning your investment gain is a bit over $2,400,000.

This is what your wealth would look like over 40 years (i.e. Age 20 to 60) if you just invested $6,000 per year ($500 per month).

This is called compound interest.

Compound Interest

Compound interest refers to the growth of money over time. Over time, your money grows interest. Then, your interest will grow interest. Then, your interest's interest will grow interest. And so on.

Einstein called this the “8th wonder of the world.”

“All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.”

In essence, you will never become rich from saving alone. You must take advantage of compound interest to grow wealth. This is achieved through investing.

To convince you further, notice that saving $6000 per year only equates to $240,000 total over 40 years — far from what most Americans would need to retire comfortably at 65. Even if you put this in a high yield savings account, you would only get about $255,000 in total (a gain of $15,000 over 40 years). Intuitively, unless you have extremely high income and expect to be able to save enough to actually retire, you will HAVE TO invest.

Before we move further, I would like to reiterate that none of this should be construed as financial advice. All investing involves risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Historical returns, expected returns, and probability projections are provided for informational and illustrative purposes, and may not reflect actual future performance. Please consult professional counsel before implementation.

In investing, you can break down all investing to occur within two accounts (for most people):

A tax-advantaged account

A non-tax-advantaged account

The following sections will discuss both of these types of accounts as well as the most common versions that you likely already have at your disposal.

Tax-Advantaged Account

A tax-advantaged account is exactly what it sounds like.

Tax-Advantaged Account

A tax-advantaged account is an account that gives you a tax advantage (or tax benefit) for using it. This comes at the cost of certain restrictions such as age and withdrawal restrictions. They allow you to save money on taxes now or later, depending on their use and configuration.

The 401K (or 403a/403b)

The most basic form of a tax-advantaged account is the 401k (or 403a/403b if you work in public service institutions). This is an account offered by your company. Note: If you are self-employed, you are likely eligible for a Solo-401k, but this will not be covered in this guide.

With a 401k, most companies offer a 4% match. What this means is that if you contribute 4% of your income (let’s say thats $2,000), your company will match your contribution of 4% and put in $2,000 on your behalf. This is free money and part of your total compensation. You would be stupid not to take this unless you like losing 4% of your salary for no reason.

Moreover, your employer may offer a Roth 401K and a Traditional 401k option.

Whenever you see or hear someone say “Roth”, all this means is that you are taxed upfront. As an example, let’s say you want to contribute $2,000 to your Roth 401k. Before it goes into your Roth 401k, it will get taxed now. Assuming your tax rate is approximately 20%, you would in reality only have $1,600 in your Roth 401k since you paid the taxes upfront. The benefit is that any capital gains on this money is TAX-FREE in the future.

Compare this to the “Traditional” 401k where you would pay taxes later. So in our example, your Traditional 401k would actually have the full $2,000 upfront. However, when you pull the money out in the future, you will be taxed. Assuming the same tax rate, you would basically end up with the same amount of money.

In reality, there is no mathematical difference between the two ASSUMING the tax rates are the same in the beginning and the end. The benefit in choosing one or the other is if the tax rate changes (which it is very likely to do by the time you retire). If you believe that your tax rate will be higher when you retire, it is better to do the ‘Roth’ option. Vice versa, if you believe your tax rate is higher now, then it is better to do the ‘Traditional’ option.

As of 2021, the limit that you can contribute to a 401k is $19,500 out of your paycheck. You must be 59.5 years old to withdraw from this account without penalty.

The Individual Retirement Account (IRA)

The IRA is an account that you can open separate from the 401k. Most brokerages like Schwab and Vanguard offer this account type and it takes about 5 minutes to open.

Like the 401k, it has a ‘Roth’ and ‘Traditional’ offering. Since most people use Traditional 401ks in their company, I usually say that a Roth IRA is more beneficial because it offers tax-free income in your retirement which can be more flexible as you plan your retirement. Also, with a Roth IRA, you can withdraw the principal (what you’ve contributed) without any penalties — you just can’t withdraw the capital gain, or the return. More on retirement planning farther down.

One of the benefits of the IRA over the 401k is that you are free to invest in whatever you want. Most 401ks have set funds that you must use. IRAs generally have access to the entire stock and bond market.

As of 2021, the limit you can contribute to an IRA is $6,000. You must also be 59.5 years old to withdraw from this account without penalty. Note: This limit is why an IRA is not as powerful as a 401k.

The Health Savings Account (HSA)

The HSA is the MOST powerful tax-advantaged account. It’s often referred to as the “Triple-Tax-Advantaged” account. You don’t get taxed on the contribution into this account, you also don’t get taxed on its use for qualifying health expenses, and you don’t get taxed on taking the capital gains out (if you reach full retirement age).

Effectively, this account works as a “medical” checking account that is funded with pre-tax income that allows you to withdraw from it for qualifying medical expenses. However, let’s say you have $50,000 in your HSA, you could take $10,000 and leave it as your medical fund, and take the other $40,000 and invest it in the market and use it as another investment account.

No taxes? This sounds too good to be true, right? Well, the no taxes part is true if you use it correctly. However, the cost of having this account is that you are only eligible to open one if you opt for a High Deductible Health Insurance plan. This means you have to pay a lot upfront if you get sick before the insurance kicks in to pay for it. For younger people, this is often fine since you don’t see the doctor often. For older people, it might get expensive to have a plan like this.

The Non-Tax-Advantaged Account

This is exactly what it sounds like: the opposite of the tax-advantaged account.

Non-Tax-Advantaged Account

A non-tax-advantaged account is an account that offers no tax advantages (or no tax benefits) for its use.

These are basically just called “Taxable Brokerage Accounts.” It’s where you can just sign up for an account and begin investing with post-tax money (money that you get in your bank account after taxes are taken out — AKA your net income).

While most people opt for the tax-advantaged accounts for obvious reasons, they have a fatal flaw. You can’t withdraw from them until 59.5 years of age. For those looking for early retirement or to be able to withdraw from your investments before this age will likely look into a regular taxable account.

The way these work, is you invest your net income, and if you have capital gains (or you earn money on your investments), you would pay a capital gains tax.

For investments held for less than 1 year, you would be subject to short-term capital gains tax, which is equivalent to your income tax bracket.

For investments held for more than 1 year, you would be subject to long-term capital gains tax, which may be 0%, 15%, or 20%, depending on your finances.

However, it’s not sunshine and rainbows. If you lose money on your investment, you don’t get any tax benefit. This is the major downfall for this account. Essentially, if you took a $10,000 loss on your investments in a particular year, it would be the same as just lighting $10,000 on fire and walking away. But if you do take a win on your investment, the government ends up taking a portion of it.

Asset Types

There are a ton of asset classes that people invest in that we could cover. I’ll cover the most common in this section.

Stocks

Bonds

Real Estate

Cryptocurrencies

Precious Metals

Stocks

These are likely the most known and most traded asset class. Stocks are partial ownership ‘slices’ in a company. For example, if Apple has a total of 100 shares of stock, and someone owned 10 shares, they would effectively own 10% of Apple. In essence, owning stock is owning a piece of a company.

Stocks can make you money in two ways:

Appreciation — the increase in price of the stock. There are nuances to stock prices, but in essence, as demand grows for a stock, the price goes up. The vice versa is true. As demand drops for a stock, the price goes down.

Dividends — these are payments paid out by a company’s profit. These are usually paid out on a quarterly basis, but they are not required to be paid out. For example, if a stock is worth $100, and the company issues a $1 annual dividend, each quarter, you would receive $0.25.

So, the strategy here to make money is to buy stocks that you think will go up in value or have been known to pay out a consistent dividend.

Bonds

Bonds are basically loans to a company or government. These are generally low risk, but have low returns.

The way they work is a company or government will need to raise funds to complete a project. For example, let’s say San Francisco must build a new road. To get money to fund the new road, they may issue a bond. As a wealthy investor, you can purchase the bond from San Francisco. In return, the bond has an interest rate attached that you are to be paid.

For our generation, most people are unlikely to hold bonds directly. For our parents’ generation, bonds were more common because the interest rates were 10%+ for many parts of history. Compare that to our interest rates of 1-2%. Because of their lower return, they have fallen out of favor as an asset class.

Real Estate

Real estate can be invested in, in a number of ways: commercial, raw land, residential, and industrial. Most individuals will ever only invest in residential and raw land due to the high purchase price point of commercial and industrial real estate.

I’ll cover strategies in my Investments Guide. But in general, you can make money similar to how you would with stocks: Appreciation (the price of the home going up over time) and Dividends (rental payments that pay down any loans or end up as cash flow into your bank account).

Cryptocurrency

This is a brand new asset class. Many are wary of using it as an investment as they are generally extremely volatile (meaning they go up and down in value quickly). This asset class includes things like Bitcoin, Ethereum, Dogecoin, and more.

The only way to make money is if the demand of the cryptocurrency increases.

Precious Metals

This is typically one most people understand. Gold, Diamonds, and Silver are common metals that have held their value over the course of history. Over time, the price of each tends to go up. But their price tends to not increase much more than inflation, so it is more of a “Store of Value” rather than an investment in my eyes.

Mutual Funds (MFs) and Exchange Traded Funds (ETFs)

Most people nowadays store most of their investment in either a MF or an ETF. They are almost the same, but are set up differently.

MFs are companies that take your money (and the money of others) and invests it for you with a diversified fund. Some of these track Stock Market Indices like the S&P500 or Dow Jones.

Conversely, ETFs are special vehicles set up by a company that trade similar to a stock on the stock market. However, these ETFs hold a ‘basket’ of stocks and bonds within them. Many also track industries or stock market indices.

These are semantic differences though.

The main difference is that MFs are usually actively managed by a portfolio manager. MFs have high expense ratios, or annual fees for investing with the MF. These fees may go upwards of 1% of the amount invested. In contrast, ETFs are usually passively managed meaning they just track an index. This makes their expense ratios much lower (usually <0.1%), which may save you lots of money over the long run.

Investing Philosophies

I know I said I wouldn’t get into Investing Philosophy in this guide, but I thought I would share one: Modern Portfolio Theory (MPT). For other philosophies, check out my Investments Guide.

MPT is a Nobel Prize winning research study done in the 1950s that tried to find the trend between maximizing investment return and minimizing potential risk. This research was done by Harry Markowitz.

Harry argued that investors could achieve their best results by finding the optimal mix between low and high risk investments (with corresponding low and high returns) based off of an assessment of their risk tolerance. The idea here is that each person has an “Acceptable Risk” level that would decide what type of investments you would keep.

For risk-averse people, you would have a higher amount of low return, low risk options. And vice versa.

MPT is often combined with modern-day Exchange Traded Funds (or ETFs), where investors invest in ETFs that are automatically diversified for them. Taken a step further, investors will often dollar-cost-average, which means they purchase their portfolio in regular intervals no matter what the price is.

Takeaways:

Understand that investing is (basically) required to build wealth. Savings, alone, is likely not to be enough.

Invest in tax-advantaged accounts to save on taxes and increase of gains over time. Understand the difference between traditional and roth accounts.

After maxing tax-advantaged accounts, look into a taxable brokerage account.

Understand how capital gains taxes work.

Utilize tools like MFs and ETFs to quickly diversify your portfolio.

Invest for the long term using a strategy that suits your risk profile and risk tolerance.

7

Taxes

Taxes. Everyone’s favorite topic. Not. Everyone knows taxes are necessary, but everyone hates taxes. Taxes are how governments are funded, which are required for our society to function.

“...everything seems to promise it will be durable; but, in this world, nothing is certain except death and taxes.”

This famous quote has panned out for all of history. All people have paid taxes since there has been governments and rulers.

So since you’re basically guaranteed to pay taxes, let’s take a look at the most common ones you’ll pay. I won’t go through how to calculate your own taxes and the works in this guide. But you can find that information in my community, The Million Impact Mission Community. I highly recommend you use a tax preparer to ensure you file your taxes correctly to avoid fines and fees.

Common Taxes

The most common taxes in the U.S. that basically all taxpayers will come across are:

State and Federal Income Taxes

Social Security Taxes

Medicare Taxes

Property Taxes

State and Federal Income Taxes

This is a tax on the income that you make annually. If you are employed by another company, it is likely that they take this out of your income directly before depositing your income into your bank account.

Not all people will pay a State Income Tax. For example, some states like Texas do not have any income taxes. But some states like California have very high income taxes.

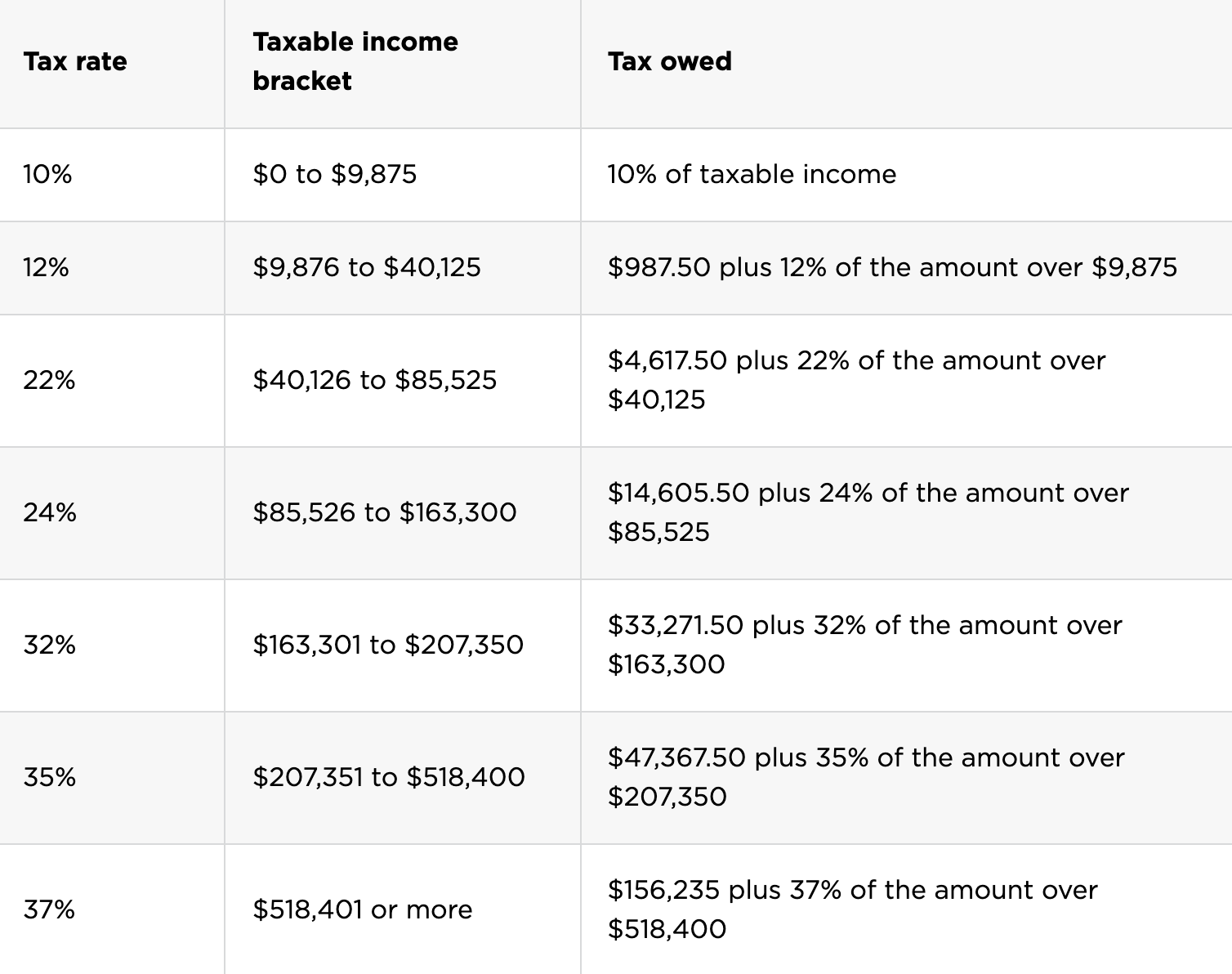

To understand how our Income Tax System works, we must understand the type of system it is. The United States tax system runs on a progressive tax system, which basically means that the more money you make, the more taxes you pay.

This works by using Tax Brackets, which are different taxation levels for each $1 you make. For 2021, the brackets looked like this for single people:

Noticed that I specified Single people. This is what is referred to as a Tax Filing Status. You can file under one of the following depending on which you qualify.

Single

Married Filed Jointly

Married Filed Separately

Head of Household

You would obviously want to file under whichever saves you the most money (and that you are qualified for). This is where it would be best to consult proper professionals to guide you in the best direction.

What Are Tax Deductions?

When filing your taxes, your tax advisor will ask you (or calculate for you) if you should take a standard deduction or an itemized deduction.

A standard deduction is a set amount set by the government of how much you can take off of your taxable income. For example, the 2021 Standard Deduction for Single tax filers was $12,550. So if you made $100,000 in 2021, you would only get taxed on $87,450 (from $100,000 - $12,550). Everyone is eligible for the standard deduction.

An itemized deduction is dependent on your individual situation. The majority people who take the itemized deduction are usually real estate investors. But you can basically total up things within state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. If the total sum of these is greater than the standard deduction, you would want to itemize it. However, most people usually do not take the itemized deduction.

Note: If you run a business, there is a separate set of “Tax Deductions” rules for businesses specifically. This guide will only cover ideas from a personal income standpoint.

What Are Tax Credits?

Tax credits are government “give-back” programs for various reasons. These effectively are free money programs meant to offset the cost of taxes as well as incentivize behaviors such as going to school and work. In most cases, they have restrictions on who is eligible (usually based off of income). High-income earners generally have lower amounts of eligible credits to use for taxes.

The most common are:

Earned Income Tax Credit — This is literally the government paying you back up to $2500 for working. The idea was to incentivize people by offsetting some of the Social Security taxes with this tax credit.

American Opportunity Tax Credit — This tax credit pays for up to $2500 annually for school expenses for the first 4 years of a post-secondary education.

Lifetime Learning Credit — This is very similar to the previous except it has an allowance up to $2000, and can be used for any year of post-secondary education.

Child and Dependent Care Credit — This is a tax credit for those with children under the age of 13 to offset the cost of childcare up to $3,000 per child. Note: This amount was heavily increased during the COVID-19 pandemic, but is expected to go back down to this number.

Savers Tax Credit — This is a tax credit for up to $1,000 if you contribute to a 401k.

Tax and Government Incentives

So why did the government create such a complicated tax system? It’s because they want to brain control you, of course. I’m half kidding.

By creating tax deductions and credits, the government is able to influence the economy and your personal choices. For example, the rules are set so that you can deduct mortgage interest on your personal income taxes. This encourages you to purchase a home, and thus, the government is incentivizing home ownership. Another example is the fact that long term capital gains is taxed at a lower rate than personal income, which encourages investing.

This type of “encouragement” or “incentive” is baked right into our tax system and it’s carefully crafted that way. For most wealthy people, they have a trusted tax advisor who can help them navigate all the rules to maximize the amount of money they can keep each year. And I highly recommend that you also find a trusted tax advisor.

How To Find A Tax Advisor

For extremely wealthy people and people with businesses, it would be best to consult a Certified Public Accountant (CPA). For the rest of us, someone with the Enrolled Agent (EA) certification from the IRS will suffice. Both of these people have done training and are required to do training each year to maintain their certifications, which means they are always up to date on new changes to tax law.

What Are Some Strategies To Lower Taxable Income?

I’ve mentioned earlier that Traditional 401ks, Traditional IRAs, and HSAs are tax-advantaged accounts. These all work to lower your taxable income. For example, if you are putting $6,000 in your Traditional 401k, you taxable income will be $6,000 less for the year, which is a massive advantage. This is the lowest hanging fruit to lower your taxable income.

The next lowest hanging fruit would be to prune your taxable investments. What this means is that you’ll want to sell off investments in your portfolio that have lost value. By selling them before the end of the year, you can use those losses to offset any capital gains that you may have taken in the year as well. If you have 0 capital gains for the year, you can deduct up to $3,000 against your regular income for 2021. Please look up the appropriate amount for the year we are in.

For business owners real estate investors, there’s a number of other tax deductions and strategies that you can do to lower your tax bill, but these won’t be covered in this guide. To reiterate, I strongly encourage all people to find a trusted tax advisor to talk to your specific situation.

Takeaways:

Understand that our tax system is a progressive system.

Understand how tax deductions and tax credits work.

Find a trusted tax advisor who can advise you on your taxes.

Lower taxable income if possible using tax-sheltered accounts, capital losses, or business tax deductions.

8

Insurance

By now, you’re probably think that there’s too many parts to this “Personal Finance” thing. One that often gets overlooked is Insurance. Insurance is an extremely important part to personal finance that most people often don’t think about. But let’s think about it: why build millions of dollars of wealth if you can lose it in an instant when something goes wrong? That’s why you need insurance.

Insurance protects wealth. Insurance works by reducing the amount of risk by spreading risk over a large number of people. For example, having 500 people pay for $5000 bill (at $10 each person) is much easier to swallow than having 1 person pay for the entirety of the $5000 bill.

Some people like to say that they would “self-insure” themselves meaning that they will save money to insure against any incursions. This works in some areas of life but not others.

Types of Insurance

For the average person, here are all the insurance types you would probably want to purchase:

Homeowners Insurance (or Renters Insurance) — this is coverage for your home which may cover things like natural cause damage, theft, and more.

Automobile Insurance — this is coverage for your vehicles from any damage such as a collision, which may include coverage for collisions where you are at fault.

Umbrella Insurance — this is insurance that covers all of the above in the case that each individual one is not enough to cover the loss or damage.

General Liability Insurance — this is insurance that protects you “generally” from most damages that might occur on your property or caused by you directly.

Professional Liability Insurance — this is coverage for working professional service workers (such as doctors, lawyers, etc) if they are ever held liable for damages suffered by their clients due to professional mistakes.

How To Buy Insurance

You’ll need to connect with an insurance agent (who usually works for an insurance broker). These are people who can enter into, change, and cancel insurance policies issued by their designated company.

As part of an insurance agent’s service, they will help you calculate how much insurance someone in your specific situation may want to have as well as the different types of insurances you may want. For example, if you drive an old car only worth $500, you may not need to buy insurance that also covers the cost to replace your car, but you would want insurance that covers the car that you collide with. These decisions should be made alongside an insurance agent who can advise you on the policy and scenarios it covers.

Also note, some insurance agents may be highly specialized. This is often the case with Professional Liability Insurance where the agent may only sell this one type of insurance versus going to a larger brand that may work with all types of insurance.

There is often a huge advantage to going with a larger insurance company. It allows you to create “Bundles” of insurance.

Bundling insurance means that you purchase multiple policies from an insurance company in order to reduce the overall cost. For example, if an auto policy costs $100 per month and a homeowner’s policy costs $200 per month, the company pay offer both policies to you for $250 per month which saves you $50 per month.

How much does each insurance type cost? It depends.

Insurance agents will ask you a set of questions as part of their underwriting process, which is used to evaluate “how risky” you are to insure. For example, a person who smokes is more at risk for death than a person who does not smoke. This means that a life insurance policy for a smoker will be higher than a non-smoker. The insurance agent will use the questions to access your riskiness to determine your cost.

How To Collect Insurance

Let’s assume you suffer a loss. How do you actually claim your insurance policy?

Contact your insurance agent about your loss.

This should be done as soon as possible. The agent will likely send you to another person within the company who handles losses as well as documents the situation. Tip: generally speaking, the more annoying you are to these people, you often get paid out quicker (but please be nice to insurance agents).

Document losses.

You’ll want to (or rather, need to) provide proof of loss. Take photos or videos of property you purchase and keep the replacement costs handy. In the event you suffer a loss, these photos and video evidence will ensure you are fully compensated by the insurance company.

File a claim.

Filing an insurance claim, or a formal request for reimbursement, will be requested by your insurance agent. A “claims adjuster” will assess what was broken or lost as well as the payout that you should expect. They will document the losses and the amount to be paid out to you.

Sign a release.

You’ll need to sign a “release”, which is a document affirming the dollar amount to be accepted for your loss.

Takeaways:

Think about the insurance policies you may want to have.

Reach out to an insurance agent who can assist you in getting a policy.

Try to bundle insurance policies to get savings.

Understand how to file an insurance claim for losses.

9

Retirement

Retirement planning is one of the most crucial parts to your personal finance journey. Retirement is when you are no longer working and are relying on savings and investments to live.

For most people, if they could work forever, they would never have to think about retirement planning since the income will be there each year. However, since most people burn out and want to retire as they age, you’ll need to plan for the period of time where you don’t earn an active income from a job or business.

Traditionally, the early retirement age is 59.5 years old. 65 years old is normal retirement age. And 67 is now considered full retirement age. These ages are based off Social Security withdrawal abilities as well as investment account withdrawal abilities.

At 59.5 years old, you can access money in your 401k or IRA penalty-free.

At 62, you can begin withdrawing partial amounts from Social Security.

At 67, you can withdraw the full amount from Social Security.

Moreover, alongside Social Security, by 62, retirees qualify for Medicare which covers a majority of the cost for health care. This piece is extremely important as health care for people in this age group can often go upwards of $2500 per month in insurance costs alone.

How much money do you need to retire?

This amount will, of course, vary depending on your lifestyle and how much you spend. If you spend less in retirement, you need less to retire. And vice versa.

As a general rule of thumb, you can take your current expenses (or the amount you would want to spend in retirement per year) and multiply it by 25. For example, if you want to spend $40,000 per year in retirement…

$40,000 x 25 = $1,000,000

…you would need $1,000,000 in investments to retire.

This number is based off something called the Trinity Study. This is where the infamous “4% Rule” comes from. For those unaware, the 4% rule says that you can safely withdraw 4% of your investments indefinitely without ever running out of money. In our previous example,

$1,000,000 * 4% = $40,000

This is how the math works out to get the 25x multiple. Of course, this is a general guideline and it’s not bulletproof.

One thing to keep in mind is that if your expenses are $40,000 today, they are likely to be much higher when you retire due to inflation. Inflation is the general increase in prices overtime. Overall, in the U.S. the average annual inflation rate is 2%. For example, in 30 years, to get the same level of living as today’s $40,000, you would need to spend roughly $72,000. Keep this in mind when calculating your retirement expenses.

What is Financial Independence, Retire Early (The FIRE Movement)?

This section is near and dear to my heart. My primary goal right now is to reach financial independence by 30. What this means is that I’ll have enough invested at 30 years old (currently 21 years old) to cover all my basic living expenses forever, so that I would technically never have to work again.

This also reiterates my mission, The Million Impact Mission, which is to reach financial independence one day and bring along 1,000,000 other people with me.

This idea stems from the FIRE Movement. This is a movement created by Millennials who want to retire early and work on projects that they are actually interested in. The idea is to not have money be a primary motivator to work.

The FIRE Movement followers live extremely far below their means to increase their savings rate, or the percent of their income that they save each year. Recall that I said that a 10-15% savings rate is considered good financial sense by most financial experts. FIRE followers generally have a 50-90% savings rate, which means they save up to 50 to 90 percent of their take-home pay, or income.

This savings rate rapidly decreases the amount of time needed for your money to grow large enough to live off of. Most FIRE followers can often retire in 10-20 years with this savings rate compared to the average working time of 40 years for most Americans.

The FIRE Movement has become extremely attractive to younger generations such as Gen Y and Gen Z, and its popularity continues to grow. It has shown that early retirement is entirely possible.

Takeaways:

Ensure that you have enough money to retire.

Decide when you want to retire.

Increase your savings rate if you want to retire early.

Thank you for making it to the end of this guide.